So, if you’re an S corporation with three owners and delay filing for two months without having asked for an extension, the penalty is $1,170. This penalty could be even higher because the Tax Increase Prevention Act of 2014 gave the IRS authority to increase it for inflation for returns due after 2014 no increase has yet been announced.ĭifferent penalties apply to Schedule C filers and C corporations.

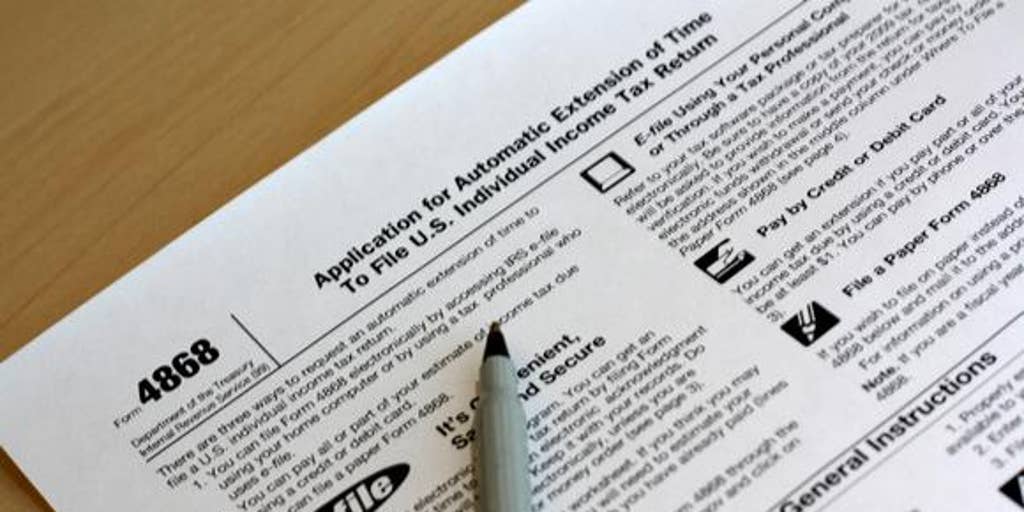

For example, for partnerships and S corporations that do not even pay any federal income tax, the penalty is $195 per month (or part of the month) per owner for the length of the tardiness. If you fail to file the return on time and don’t ask for an extension, the penalties can be hefty. 15, 2015 for Schedule C filers) to submit this year’s returns. Businesses that make a filing request have until Sept. The only catch is that you must file the request for an extension by the deadline you’re expected to meet for filing your return. A filing extension is automatic. You get it simply by asking the IRS for it.

0 kommentar(er)

0 kommentar(er)